On Tuesday night, 14 May 2024, Federal Treasurer Jim Chalmers handed down his third Federal Budget for the Labor Government. If anything, it was quite an underwhelming budget, leaning towards higher spending particularly over the upcoming year. While this is the second consecutive budget surplus for the Labor Government, there is a forecast $28.3 billion deficit for the next financial year. In fact, for the four years after the current year surplus, the forecast is for a combined deficit of $122 billion.

The economic story though is all about inflation at the moment: “When will we be rid of it?” “And how much damage has it done along the way?”

Energy bill relief – $2.6 billion – yes it makes your electricity bills cheaper today, but will this lead to upwards inflationary pressure over the longer period?

The Government indicates inflation will be under control by Christmas 2025, but many economists and perhaps, more importantly, the RBA may not agree with that.

We would still call for more broader tax reforms including reducing state based taxes like transfer duty and payroll taxes, and replacing it will greater broad based consumption taxes (like GST).

Production tax credits and critical mining projects and fast-tracked investment processes were helpful wins for the top end of town.

Impact for individuals

Individual income tax rates

As previously announced by the Treasurer, the Stage 3 individual income tax rates were amended to provide tax relief to all taxpayers.

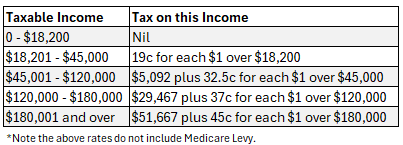

The current tax rates (to 30 June 2024) are as follows:

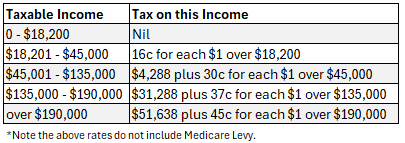

From 1 July 2024, the reduced tax rates are as follows:

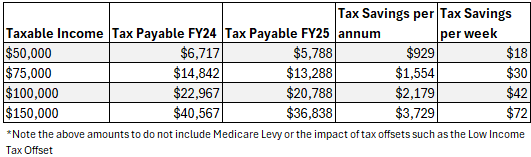

The tax savings for certain income levels are as follows:

The last table shows the difference between the tax payable for the 2024 financial year, compared to the tax payable for the 2025 financial year and how much that translates to a weekly saving.

Energy bill relief

A $300 rebate will be applied to all Australian households towards their electricity bills. This will be a $75 credit on each quarterly electricity bill in the 2024-25 financial year. Eligible small businesses will receive a credit of $325.

HECS

Another measure that was announced last week was the change to the HECS indexation rate. Currently, HECS debts are indexed each year on 1 June using the Consumer Price Index (CPI). Given the high rates of inflation, this resulted in an indexation rate of 7.1% applied to HECS debts on 1 June 2023.

The Budget announcement is to use the lower of CPI and Wage Price Index (WPI) to index HECS debts (backdated to 1 June 2023). This means that the 7.1% CPI indexation rate used last year will be replaced with a 3.2% WPI (and a credit applied to HECS accounts to reflect the lower indexation at 1 June 2023).

It is also forecasted for the WPI to be 4% for the 1 June 2024 indexation.

Please read our article for more information about the indexation of HECS debts and whether it is beneficial to repay some or all of your debt.

Medicare Levy Low-Income Thresholds

The Medicare Levy low-income thresholds for singles, families, seniors and pensioners will also be increased from 1 July 2023. The family income threshold will also now be increased by $4,027 per child (up from $3,760).

Rent Assistance

The Commonwealth Rent Assistance maximum rates have been increased by 10% from 20 September 2024 to address rental affordability challenges.

Paid Parental Leave

$1.1 billion was allocated in the budget towards paying superannuation on Commonwealth Funded Paid Parental Leave for births and adoptions on or after 1 July 2025.

Impact for businesses

The Budget contained a few measures to help small businesses:

Instant asset write-off threshold extended

From 1 July 2023, the instant asset write-off threshold was due to reduce to $1,000. Last budget, this threshold was increased to $20,000 for businesses with an aggregated turnover of less than $10 million. The increased threshold was to apply until 30 June 2024. The announcement in this budget was to extend the $20,000 threshold to 30 June 2025. We note that the announcement from last year’s budget (to increase the threshold to the $20,000) has still not passed by Parliament, leaving this measure uncertain as we close in on the end of the financial year.

We also note that, assets acquired for more than $20,000 can continue to be placed into the small business simplified depreciation pool and depreciated at 15% in the first year and 30% thereafter.

ATO Counter-Fraud Strategy

$187 million has been allocated to the ATO Counter Fraud Strategy, including allocating funds to:

- Identify and block suspicious activity in real time

- Recover lost revenue from fraud

- Counter fraud

- Extend the period for which the ATO can withhold GST refunds (extended from 14 days to 30 days)

ATO Tax Avoidance Taskforce

The ATO Tax Avoidance Taskforce has been extended for 2 years from 1 July 2026. The task force pursues key tax avoidance risks from multinationals, large public and private businesses and high-wealth individuals.

Foreign Resident CGT regime

The foreign resident capital gains tax (CGT) regime will be strengthened to provide greater certainty about the operation of the rules. The amendments will apply to CGT events on or after 1 July 2025 and will:

- Clarify and broaden the types of assets that foreign residents are subject to CGT on

- Amend the point-in-time principal asset test to a 365-day testing period

- Require foreign residents disposing of shares and other membership interests exceeding $20 million to notify the ATO, prior to the transaction being executed

Supporting Small Businesses

$41.7 million has been specifically allocated to supporting small businesses, as follows:

- $25.3 million to support the Payment Times Reporting Regulator;

- $10.8 million to extend the Small Business Debt Helpline;

- $3 million to implement the Government’s response to the Review of the Franchising Code of Conduct;

- $2.6 million for the Australian Small Business and Family Enterprise Ombudsman to support unrepresented small businesses to navigate business-to-business disputes through alternative dispute resolution.

We will keep you up-to-date with the progress of the implementation of these Budget measures.

If you would like to discuss the tax implications of the budget proposals, please call us on (07) 56656469.

DISCLAIMER: The information in this article is general in nature and is not a substitute for professional advice. Accordingly, neither TJN Accountants nor any member or employee of TJN Accountants accepts any responsibility for any loss, however caused, as a result of reliance on this general information. We recommend that our formal advice be sought before acting in any of the areas. The article is issued as a helpful guide to clients and for their private information. Therefore it should be regarded as confidential and not be made available to any person without our consent.

Jeanette has over 20 years experience as an accountant in public practice. She is a Chartered Accountant, registered tax agent and accredited SMSF Association advisor. When she is not helping business owners grow their empires, you will likely find her out running on the trails or at the gym. Book in to see Jeanette today.