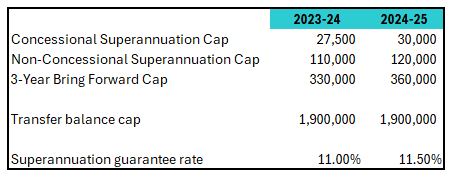

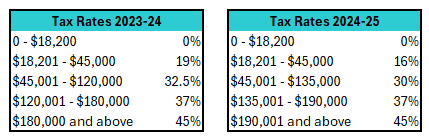

With decreasing tax rates, there are steps you can take prior to 30 June 2024 to reduce your overall tax liability.

For example, let’s say you’re earning $100,000 per year. If you paid $100 for stationery for your employment on 30 June 2024, and claimed a full tax deduction for this expense, you would receive a tax refund of $32.50 for the stationery deduction. If you purchased the same $100 stationery on 1 July 2024 (the very next day), you would only receive a tax refund of $30. So if you are earning $100,000, there is a $2.50 reduction in your tax refund for your deductions between 2024 and 2025. It is better to claim as much as you can prior to 30 June 2024 to get a tax benefit at the higher tax rates.

With the personal tax rates decreasing after 30 June, this means that any income that you make in this financial year, will be taxed at a higher rate than if you earned the same income next year.

As we are talking about individual tax rates, we need to consider if there is any income in our individual name that we can defer until after 30 June.

A good example of deferring income is the delaying sale of capital assets (for example, an investment property). When selling capital assets, the relevant date for the capital gains tax, is the date that the contract is entered into. For example, if you are selling an investment property, you are deemed to have disposed of it on the date you enter into the contract for the sale (not the date of settlement).

Examples of income to defer