Tax Planning with Decreasing Tax Rates

The basic principles of tax planning essentially remain the same every year – maximise and bring forward your deductions, and try and defer your income. Often this just results in you deferring your tax liability (not necessarily reducing it). However, in times of decreasing tax rates, you can take advantage of the decreasing rates to reduce your tax bill.

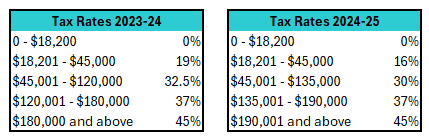

Tax Rates

Below is a comparison of the tax rates for the 2023-24 financial year and the rates currently being legislated for the 2024-25.

With decreasing tax rates, there are steps you can take prior to 30 June 2024 to reduce your overall tax liability.

Bring Forward Deductions

Any deductions that you claim in the 2024 financial year get you a higher refund than the same deduction claimed next year.

For example, let’s say you’re earning $100,000 per year. If you paid $100 for stationery for your employment on 30 June 2024, and claimed a full tax deduction for this expense, you would receive a tax refund of $32.50 for the stationery deduction. If you purchased the same $100 stationery on 1 July 2024 (the very next day), you would only receive a tax refund of $30. So if you are earning $100,000, there is a $2.50 reduction in your tax refund for your deductions between 2024 and 2025. It is better to claim as much as you can prior to 30 June 2024 to get a tax benefit at the higher tax rates.

Examples of deductions to bring forward

- Prepaying interest on rental properties or margin loans

- Repairs to your rental property

- Additional deductible superannuation contributions (to be reviewed with your financial planner

- Annual payment of income protection insurance

- Expenses due in July that you may be able to pay early

With the personal tax rates decreasing after 30 June, this means that any income that you make in this financial year, will be taxed at a higher rate than if you earned the same income next year.

As we are talking about individual tax rates, we need to consider if there is any income in our individual name that we can defer until after 30 June.

A good example of deferring income is the delaying sale of capital assets (for example, an investment property). When selling capital assets, the relevant date for the capital gains tax, is the date that the contract is entered into. For example, if you are selling an investment property, you are deemed to have disposed of it on the date you enter into the contract for the sale (not the date of settlement).

Examples of income to defer

- Sale of capital assets like property or shares (ensure the contract date is after 30 June, irrespective of the settlement date

- Customer / client invoicing

Client example

We had a client recently ask us to calculate how much additional tax they would need to pay if they sold their investment property.

If they entered into a contract to sell their investment property now, their total extra tax payable would be $38,000.

If they delayed entering into a contract until after 30 June, their total extra tax payable would reduce to $30,000 (assuming the sale price remains the same).

This is a tax savings of $8,000 simply by selling the property after 30 June and taking advantage of the lower tax rates.

Just remember – you need to enter into the contract for sale after 30 June for the income to be included as part of next year’s tax return.

DISCLAIMER: The information in this article is general in nature and is not a substitute for professional advice. Accordingly, neither TJN Accountants nor any member or employee of TJN Accountants accepts any responsibility for any loss, however caused, as a result of reliance on this general information. We recommend that our formal advice be sought before acting in any of the areas. The article is issued as a helpful guide to clients and for their private information. Therefore it should be regarded as confidential and not be made available to any person without our consent.

Jeanette has over 20 years experience as an accountant in public practice. She is a Chartered Accountant, registered tax agent and accredited SMSF Association advisor. When she is not helping business owners grow their empires, you will likely find her out running on the trails or at the gym. Book in to see Jeanette today.