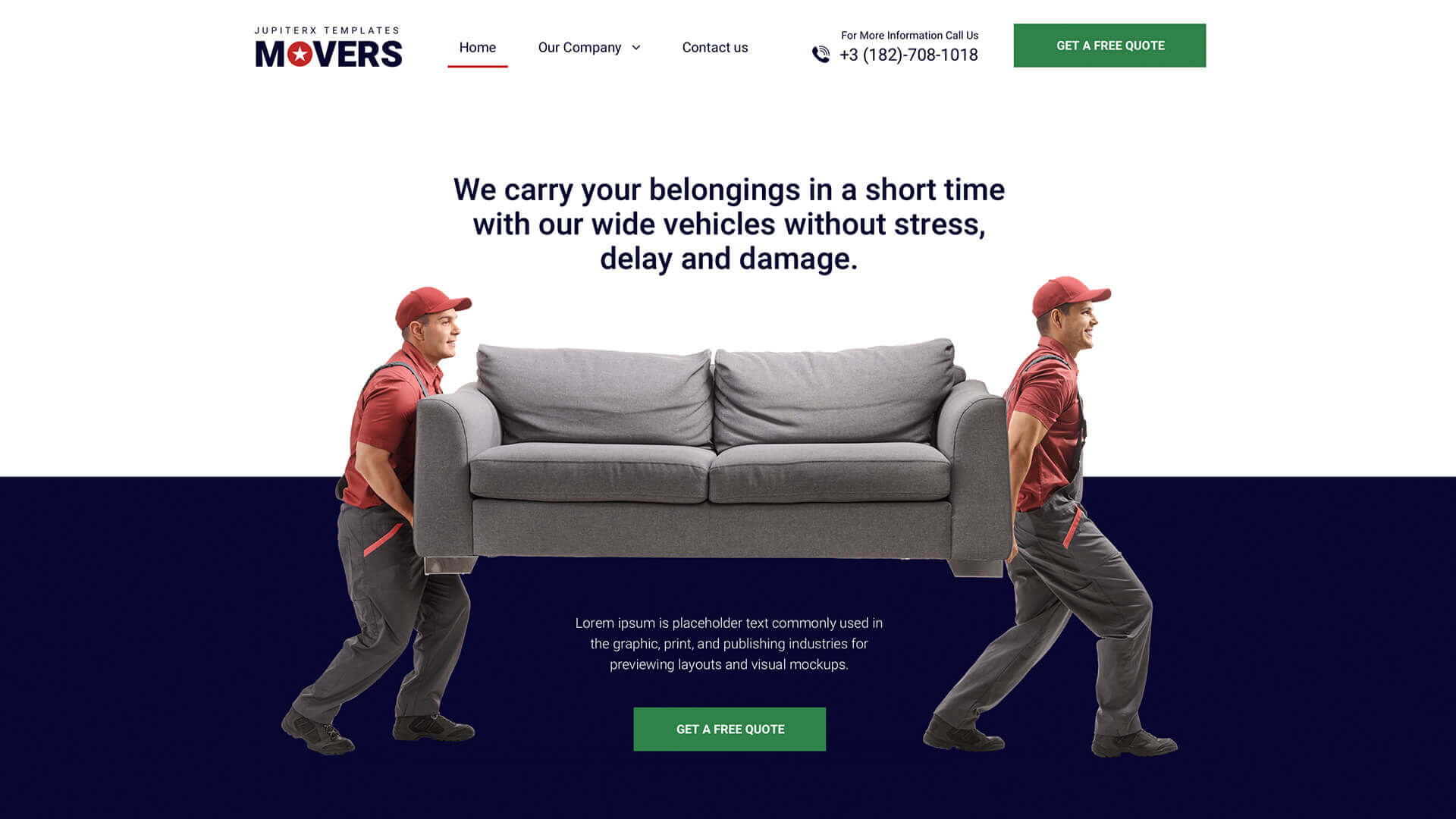

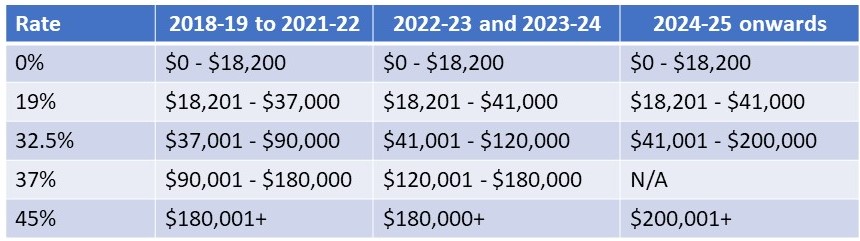

JupiterX Construction

Customer

JupiterX Construction

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident

Work

UI, UX Design, Social Media Management

Website

http://jupiterx.artbees.net/demos/construction

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore

et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut

aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse

cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore

et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut

aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse

cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore

et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut

aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse

cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident

TESTIMONIALS

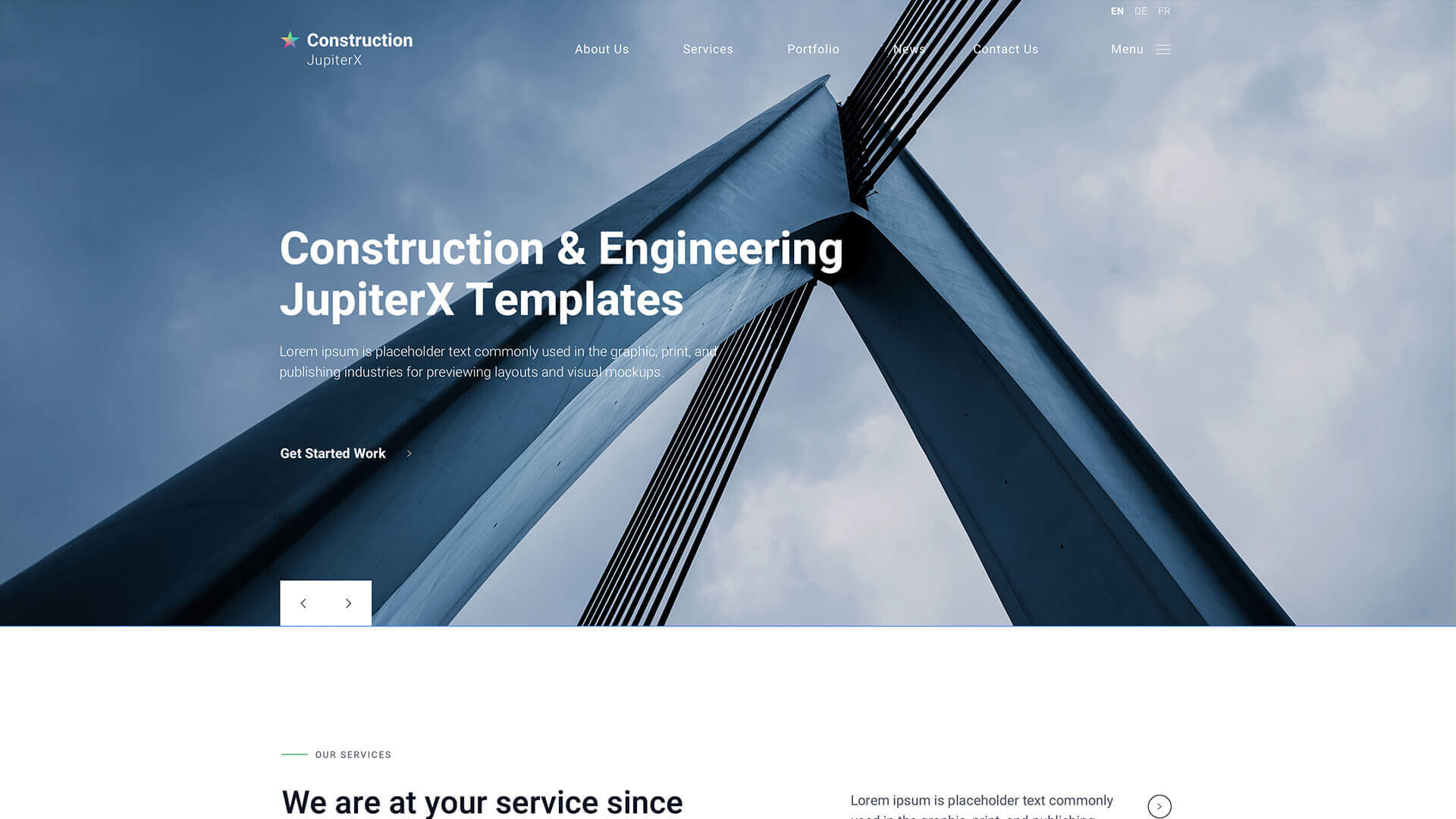

JupiterX Construction & Engineering

In order to increase the customer capacity of my beauty center, I chose to work with JupiterX and

now I see that I have made the right decision. In the first half of the year, I grew by 21% and almost

doubled the turnover in the first half of the year and this is a great success.

Dorothy Colon

Beauty Salon Manager

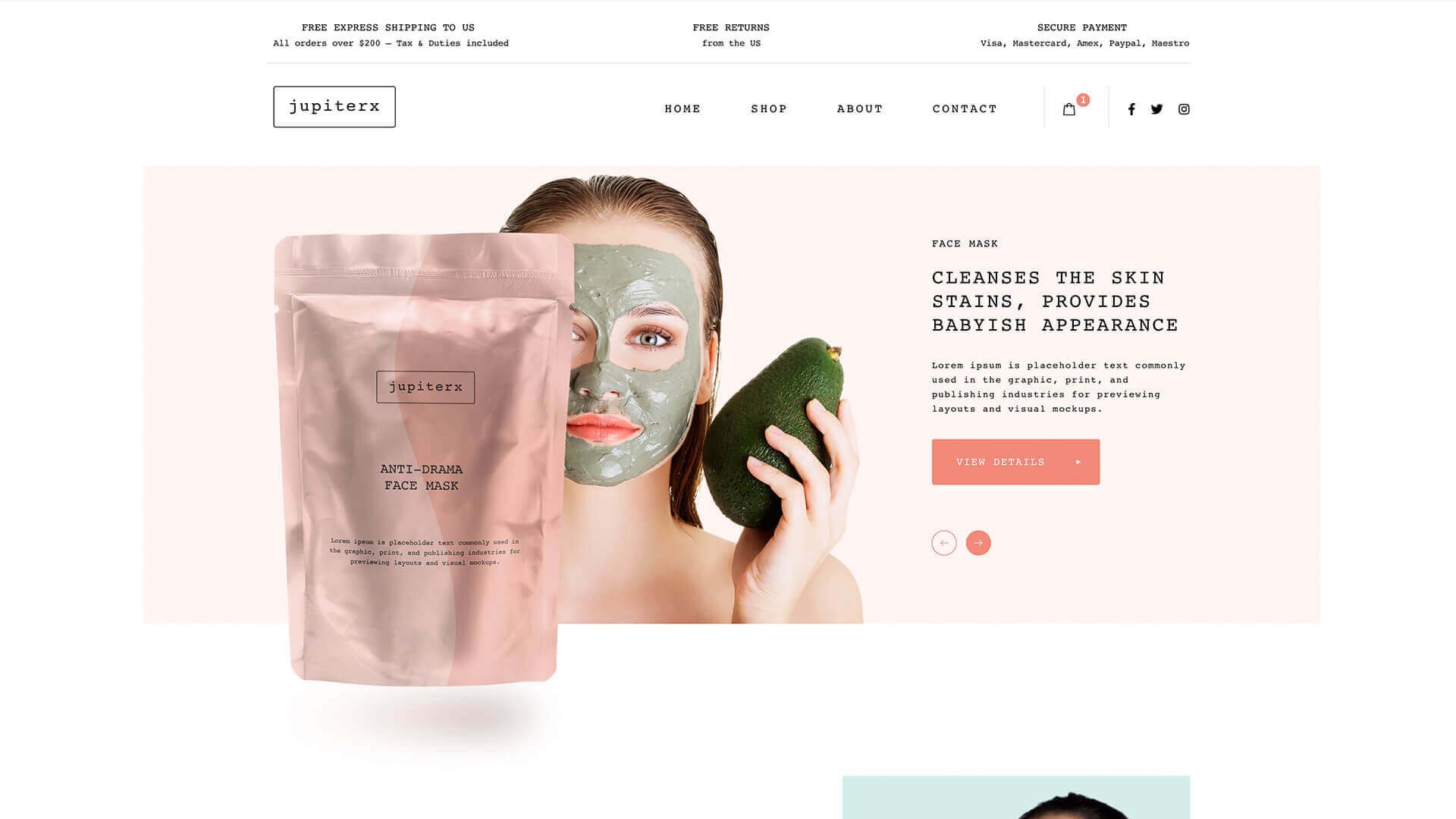

JupiterX Real Estate Company

UI, UX Design, Social Media Management

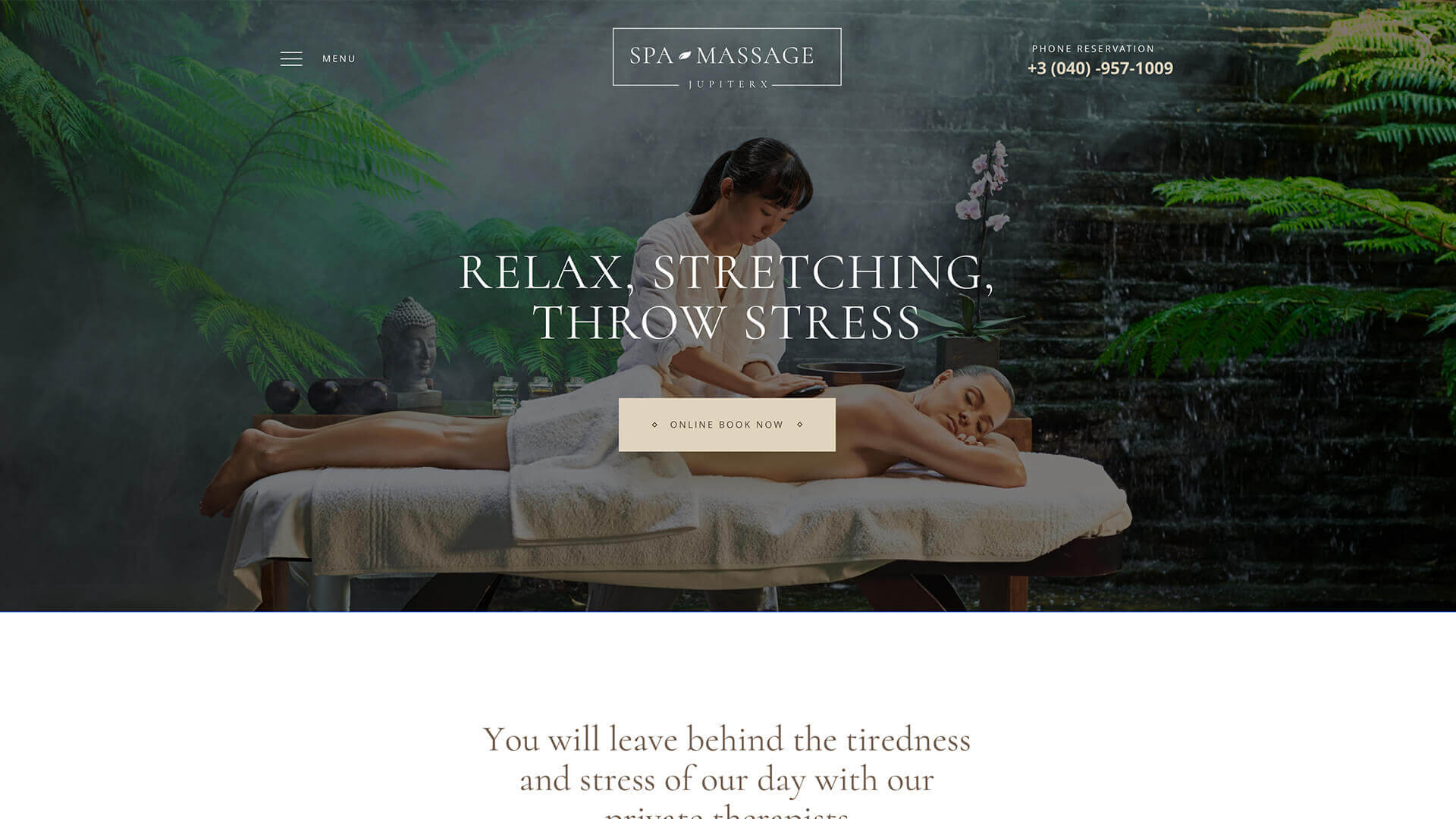

JupiterX Construct

UI, UX Design, Social Media Management

We are Expanding Your Sales and Sectoral Brand Value. Work with us, get rid of ordinary methods.

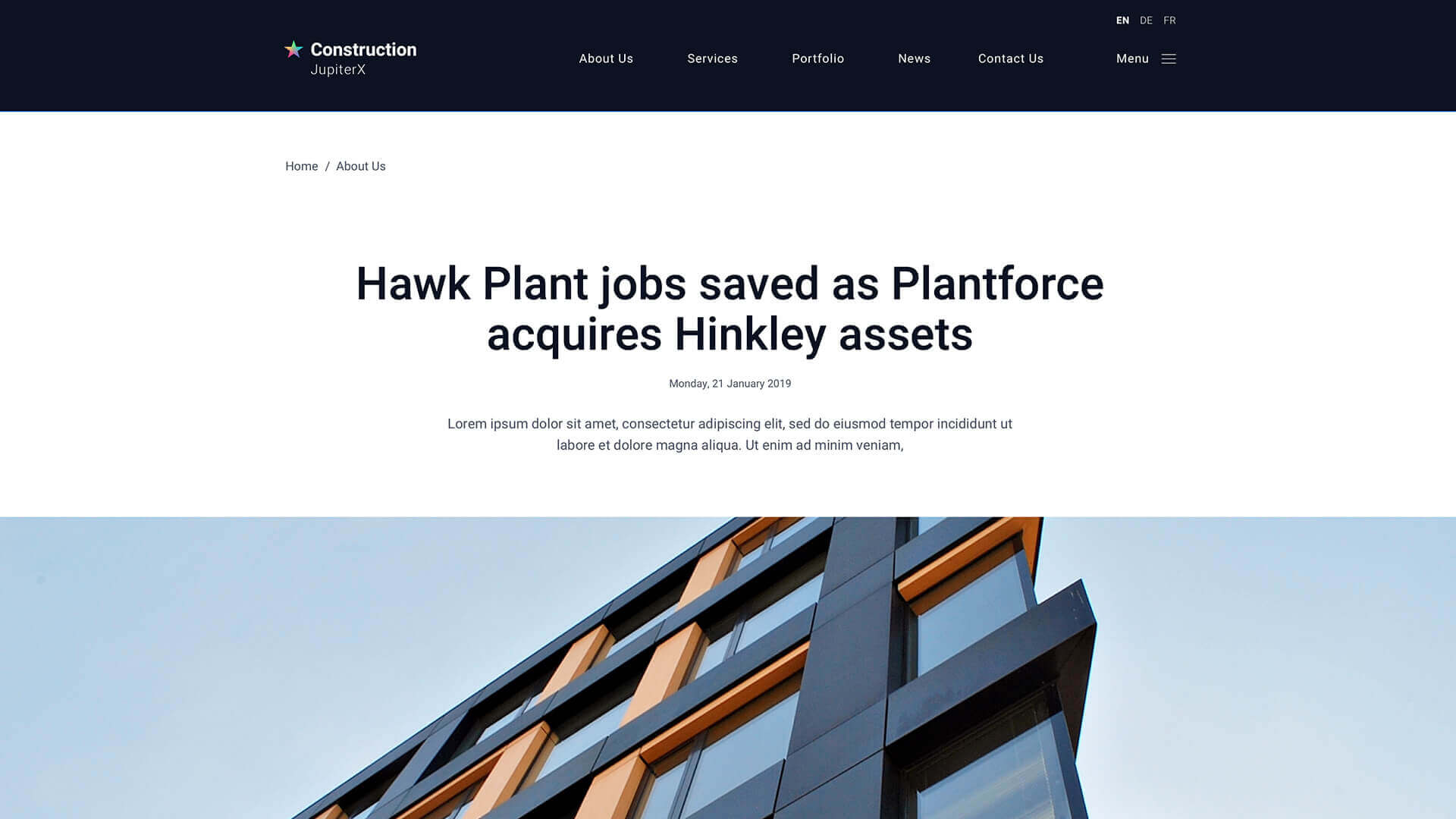

Jeanette has over 20 years experience as an accountant in public practice. She is a Chartered Accountant, registered tax agent and accredited SMSF Association advisor. When she is not helping business owners grow their empires, you will likely find her out running on the trails or at the gym. Book in to see Jeanette today.