On Tuesday night, 6th October 2020, Federal Treasurer Josh Frydenberg handed down his second Federal Budget. A long way from his “Back in the Black” surplus forecasts for this year, his second budget predicts a total budget deficit for 2020-21 of over $213 billion. Easily the biggest budget deficit we have seen since World War II, it’s a necessary requirement to alleviate the continuing negative effects of COVID-19 on business confidence and profits. We think it is safe to say that this is the most important Federal budget of our lifetime.

There are always winners and there are always losers when dissecting budget announcements. So some of the winners from this budget include:

- Individual taxpayers with cuts to individual tax rates being backdated to 1 July 2020.

- Businesses with the introduction of a temporary immediate deduction for the full cost of eligible depreciating assets.

- Companies with the announcement of a temporary loss-carry back allowance.

- Unemployed individuals also win with a JobMaker hiring credit being provided to employers that create new jobs for those people currently out of the workforce.

What wasn’t in the budget? This budget lacked any incentive for individuals to increase their wealth in superannuation and any real debate around change or movements in the GST.

We’ve outlined below some of the main and business measures that were announced in the Budget.

As with all budgetary measures, these measures are not final until the relevant legislation has been passed by the Government. Although the Federal Opposition has already professed support for the main tax changes announced, it is important that you use caution in acting on these measures until they have become law. It is our understanding that the Federal Government will be introducing an omnibus bill to Parliament today (7 October 2020) that will encompass most of the proposed tax changes. We will keep you updated on the status of these proposed measures.

JobMaker Hiring Credit

The hiring credit is aimed at increasing the employment of young people currently out of the workforce. It is available to employers for each new job they create over the next 12 months, for which they hire an eligible young person aged 16 to 35 years old.

Amount of credit

From 7 October 2020, eligible employers will be able to claim:

- $200 a week for each eligible employee they hire aged 16 to 29 years old; and/or

- $100 a week for each eligible employee they hire aged 30 to 35 years old.

New jobs created until 6 October 2021 will attract the JobMaker Hiring Credit for up to 12 months from the date the new position is created.

Eligible employers

Employers will be eligible for the JobMaker Hiring Credit if they:

- have an Australian Business Number (ABN);

- are up-to-date with tax lodgement obligations;

- are registered for Pay As You Go (PAYG) withholding;

- are reporting through Single Touch Payroll (STP);

- are claiming for an eligible employee;

- the eligible employee was hired for an additional job created from 7 October 2020 (employer’s total employee headcount and payroll cost must increase);

- have kept adequate records of the paid hours worked by the employee.

Entities who are claiming the JobKeeper Payment are ineligible for the JobMaker Hiring Credit.

Eligible employees

To be eligible, the new employee must:

- be aged between 16 – 29 (for $200 credit per week) or 30 – 35 (for $100 credit per week);

- have worked at least 20 paid hours per week on average for the full weeks they were employed over the reporting period;

- commenced their employment between 7 October 2020 and 6 October 2021;

- have received JobSeeker Payment, Youth Allowance or Parenting payment for at least one of the previous three months at the time of hiring;

- be in their first year of employment with this employer.

Employees will be ineligible where the employer is also receiving a wage subsidy under another Commonwealth program for that employee.

How does it work?

The JobMaker Hiring credit will be claimed in arrears from the ATO. Registrations will open for eligible employers on 7 December 2020. (Employers do not need to be registered at the time they hire an employee in order to be eligible.)

Claims for the credits can be lodged from 1 February 2021. The credit will be paid quarterly in arrears.

JobMaker - Apprentice Wage Subsidy

Businesses of any size can claim the new Apprentices Wage Subsidy for new apprentices or trainees who commence between 5 October 2020 and 30 September 2021. Eligible businesses will be reimbursed 50% of an apprentice or trainee’s wage up to $7,000 per quarter (capped at 100,000 places).

Lower taxes

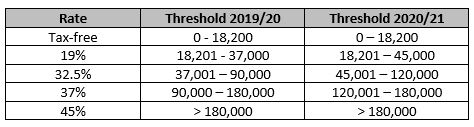

Previously legislated cuts to individual income tax rates have been brought forward and will be backdated to 1 July 2020. The table above shows the new tax thresholds.

We note that the company tax rate for the 2020/21 financial year has already been reduced to 26% for base rate entities (turnover less than $50 million).

Deduction for depreciation assets

From 6 October 2020 to 30 June 2022 businesses with a turnover up to $5 billion can deduct the full cost of eligible depreciating assets of any value in the year they are first used or installed ready for use. This applies to new and second-hand assets if the turnover of the business is less than $50 million. Small businesses with a turnover of less than $10 million can write-off the full balance of their simplified depreciation pool at the end of the year in which this measure applies.

Loss carry-back for companies

Companies that make a loss in the 2019-20, 2020-21 and/or 2021-22 financial year can carry this loss back to reduce taxable profits made on or after 2018-19. The company can elect to receive a refund of the tax paid when lodging the later year tax return. This measure will enable companies to take advantage of full expensing of depreciating assets while it is available.

Other measures

Other measures announced in the budget include:

- Additional $2 billion for R&D tax incentive;

- Small business tax concessions available to more businesses with the turnover threshold increasing from $10 million to $50 million;

- Granny flats exempted from CGT where certain conditions are met;

- Measures to be introduced to stop new superannuation accounts being created every time you start a new job. Existing superannuation accounts to be attached to taxpayers and employers will have access to this information to enable payments of employee superannuation.

- Two $250 economic support payments made in November 2020 and early 2021 to pensioners;

- Reforms to lending laws to reduce the regulatory burden on consumers and small businesses;

- $7 million allocated to support the mental health and financial well-being of small businesses impacted by COVID-19.

We will keep you up-to-date with the progress of the implementation of these Budget measures.

If you would like to discuss the tax implications of the budget proposals, please call us on (07) 56656469.

DISCLAIMER: The information in this article is general in nature and is not a substitute for professional advice. Accordingly, neither TJN Accountants nor any member or employee of TJN Accountants accepts any responsibility for any loss, however caused, as a result of reliance on this general information. We recommend that our formal advice be sought before acting in any of the areas. The article is issued as a helpful guide to clients and for their private information. Therefore it should be regarded as confidential and not be made available to any person without our consent.

Jeanette has over 20 years experience as an accountant in public practice. She is a Chartered Accountant, registered tax agent and accredited SMSF Association advisor. When she is not helping business owners grow their empires, you will likely find her out running on the trails or at the gym. Book in to see Jeanette today.