|

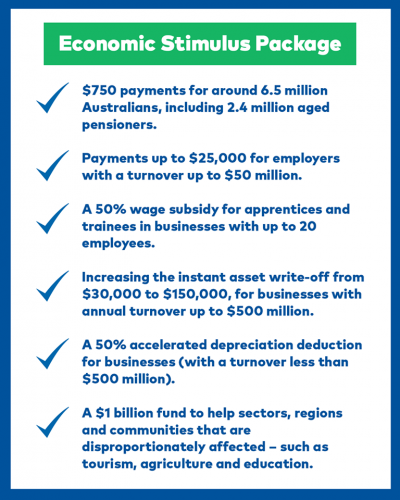

Yesterday the Federal Government announced an economic stimulus package designed to protect our economy from the impact of the Please find below a summary of these measures and how they may apply to you and your business. Please call us to discuss how We also urge you to contact us immediately if you are experiencing financial hardship. We will help to address your concerns, assess |

Instant asset write-off

|

Immediate deduction for assets costing < $150,000 Currently, eligible businesses can claim an immediate tax deduction for the purchase of assets up to $30,000. Under the stimulus 50% upfront deduction for new assets Where eligible businesses can’t claim an immediate deduction for an asset (either it cost more than $150,000 or it was purchased after 30 June 2020), they may be eligible for an upfront deduction of 50% of the cost of the asset (with existing depreciation rules applying Who will benefit? Businesses that are looking to buy plant and equipment within the next 15 months. Effect of measure It will bring forward a tax deduction for the cost of the asset (or part of the cost of the asset).For most companies, this will bring Example On 1 May 2020, a company buys a second-hand tractor for $140,000 (excluding GST) for use in its business. Under the existing rules, in the 2019/20 financial year the company could claim a tax deduction of $3,899 (assuming the tractor had a Under the stimulus package, in the current financial year the company could immediately claim the full $140,000 as a tax deduction. Consequently, the company will pay $37,428 less tax in the 2019/20 financial year. |

PAYG Withholding – Cash Back

|

Businesses that withhold tax on employees’ salary and wages will receive a payment equal to 50 per cent of the tax withheld on wages up to a maximum payment of $25,000. The minimum payment an employer will receive is $2,000 (even if they are not required to The “payment” from the Government will be recorded initially as a credit to the business upon lodgement of their activity statement. If Quarterly BAS lodger – example If you lodge your BAS quarterly, and you employ staff, you will be eligible for a credit against your March 2020 and June 2020 BAS For example, if you reported PAYG withholding of $4,570 in your March 2020 BAS and $5,000 in your June 2020 BAS, you will receive a credit of $2,285 against your March 2020 BAS (50% x $4,570) and $2,500 against your June 2020 BAS (50% x $5,000). Alternatively, if you reported PAYG withholding of $57,000 in your March 2020 BAS and $55,000 in your June 2020 BAS, you will Monthly BAS lodger – example If you lodge your BAS monthly, and you employ staff, you will be eligible for a credit against your March 2020, April 2020, May 2020 For example, if you withhold $5,000 per month for your employees, in March, you will be eligible for a credit of $7,500 ($5,000 per Employers without PAYG withholding Some employers do not need to withhold tax for their employees as they are below the tax-free threshold. That is, the employer is |

Subsidies for apprentices and trainees

|

Eligible employers can apply for a wage subsidy of 50% of an apprentice’s or trainee’s wage paid between 1 January 2020 and 30 Eligibility The subsidy will only apply where the following conditions are met:

Timing

Employers can register for the subsidy from early April 2020 with final claims to be lodged by 31 December 2020.

|

Household stimulus payments

|

A one-off $750 payment will be made to around 6.5 million eligible recipients. The payment will be exempt from tax and will not count as income for social security purposes. The one-off payment will be made automatically from 31 March 2020. Over 90 per cent of the Eligibility To be eligible, you must be residing in Australia and be receiving one of the following payments or hold one of the following concession |

- Age Pension

- Disability Support Pension

- Carer Payment

- Parenting Payment

- Wife Pension

- Widow B Pension

- ABSTUDY (Living Allowance)

- Austudy

- Bereavement Allowance

- Newstart Allowance

- Youth Allowance

- Partner Allowance

- Sickness Allowance

- Special Benefit

- Widow Allowance

- Family Tax Benefit, including Double Orphan Pension

- Carer Allowance

- Pensioner Concession Card holders

- Commonwealth Seniors Health Card holders

- Veteran Service Pension; Veteran Income Support Supplement; Veteran Compensation payments; War Widow(er) Pension; and Veteran Payment

- Veteran Gold Card holders

- Farm Household Allowance

Assistance for severely affected regions

|

The Federal Government has set aside an initial $1 billion to support the regions and communities that have been disproportionately Some of these initial measures include: |

- Waiver of fees for tourism businesses to operate in national parks and marine parks;

- Administrative relief for certain tax obligations for taxpayers affected by the Coronavirus outbreak (assessed on a case-by-case basis).

Other measures

| The ATO will also be implementing a number of administrative measures to assist taxpayers facing financial difficulty as a result of Coronavirus. Available options include: |

- deferring by up to four months the payment date of amounts due through the business activity statement, income tax assessments, FBT assessments and excise

- allowing businesses on a quarterly reporting cycle to opt for monthly reporting to get quicker access to GST refunds

- allowing businesses to vary PAYG instalment amounts to zero for the March 2020 quarter (and claiming a refund for the instalments made for the September 2019 and December 2019 quarter)

- remitting any penalties and interest, incurred on or after 23 January 2020, that have been applied to tax liabilities

- working with businesses to help them pay their existing and ongoing tax liabilities.

| DISCLAIMER: The information in this article is general in nature and is not a substitute for professional advice. Accordingly, neither TJN Accountants nor any member or employee of TJN Accountants accepts any responsibility for any loss, however caused, as a result of reliance on this general information. We recommend that our formal advice be sought before acting in any of the areas. The article is issued as a helpful guide to clients and for their private information. Therefore it should be regarded as confidential and not be made available to any person without our consent. |

Jeanette has over 20 years experience as an accountant in public practice. She is a Chartered Accountant, registered tax agent and accredited SMSF Association advisor. When she is not helping business owners grow their empires, you will likely find her out running on the trails or at the gym. Book in to see Jeanette today.