Last night Federal Treasurer Josh Frydenberg had his turn at the wheel and handed down his first Federal Budget.

So what did we like in the Budget? We liked that there were no new taxes or increases to tax rates. We liked the proposed bring forward of the reduction to the company tax rate. We also like the increased threshold of the instant asset write-off to $30,000 and the expansion of the write-off to apply to more businesses. The proposed income tax cuts are also welcomed and may help relieve some family financial stress.

We’ve outlined below some of the main tax and other business measures that were announced in the Budget.

As with all budgetary measures, these measures are not final until the relevant legislation has been passed by the Government. As such, it is important that you use caution in acting on these measures until they have become law. We will keep you updated on the status of these proposed measures.

Businesses

-

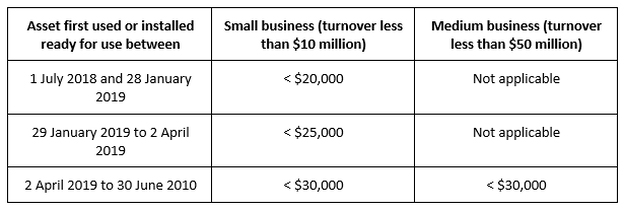

Instant Asset Write-off – The instant asset write-off will be increased to $30,000 for assets that are acquired between 2 April 2019 and 30 June 2020. More businesses will also be able to access the write-off with the turnover eligibility increasing from $10 million to $50 million. We note that there is currently legislation before Parliament to increase the current asset write-off threshold from $20,000 to $25,000 to take effect from 29 January 2019, once passed. As such, if all of the relevant legislation is passed to implement the increased thresholds, the instant asset write-off will be available as follows

- Corporate Tax Rates – From 1 July 2021, businesses operating in a company structure with a turnover of less than $50 million will have their tax rate lowered to 25% (this is 5 years earlier than original planned).

-

ABN integrity measures – The Government will look to strengthen the ABN system by requiring ABN holders to lodge their income tax returns and verify their details on the Australian Business Register annually.

Individuals

The Government has gone back to their seven-year personal income tax plan (announced in the 2018-19 budget) and made changes and updates as detailed below:

-

Seven year personal income tax plan

-

Step one – Tax Offset: A low and middle income tax offset will apply from 1 July 2018 to 30 June 2022. The offset will give taxpayers back up to an extra $1,080 if they earn less than $90,000. The offset then reduces and is completely phased out at $126,000 taxable income. This offset will exist in addition to the Low Income Tax Offset.

-

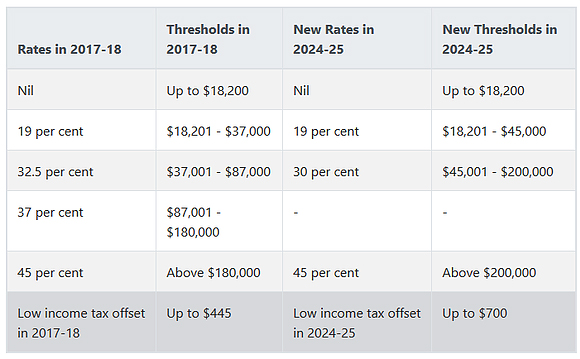

Step two – Tax Rates: From 1 July 2022, the 19% tax bracket will increase from $37,000 to $45,000. The low income tax offset will be raised to $700.

-

Step three – Simpler System: From 1 July 2024, the 32.5% marginal rate will be decreased to 30%. A summary table of the new tax rates is below:

-

Superannuation

The superannuation sector remains largely unchanged in the Budget. The main changes are:

-

Work test – From 1 July 2020, it is proposed that people aged 65-66 will be able to make voluntary contributions to super without having to meet the work test. Currently, people over 65 must work a minimum of 40 hours over a 30 day period in order to make a contribution.

-

3 year bring forward for non-concessional contributions – People aged 65 and 66 will also be able to access the 3 year bring forward provisions to make 3 years worth of non-concessional contributions to their super in a single year.

We will keep you up-to-date with the progress of the implementation of these proposed measures.

If you would like to discuss the tax implications of the budget proposals, please call us on (07) 56656469.

DISCLAIMER: The information in this article is general in nature and is not a substitute for professional advice. Accordingly, neither TJN Accountants nor any member or employee of TJN Accountants accepts any responsibility for any loss, however caused, as a result of reliance on this general information. We recommend that our formal advice be sought before acting in any of the areas. The article is issued as a helpful guide to clients and for their private information. Therefore it should be regarded as confidential and not be made available to any person without our consent,

Jeanette has over 20 years experience as an accountant in public practice. She is a Chartered Accountant, registered tax agent and accredited SMSF Association advisor. When she is not helping business owners grow their empires, you will likely find her out running on the trails or at the gym. Book in to see Jeanette today.