Last night Federal Treasurer Scott Morrison handed down his third budget. While there were no shocks or great surprises in the announcements, there were some welcome tax reform measures.

A shared feeling among most budget commentators is that this was a “victimless” budget – that is, no one particular group suffered from the announcements.

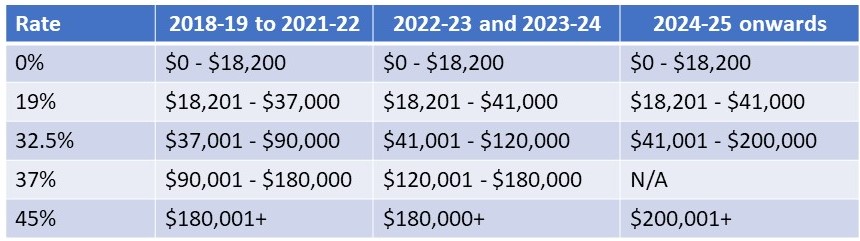

So what did we like in the Budget? Individual taxpayers will appreciate tax cuts via a low and middle income tax offset and the changes to the tax brackets. Small businesses will get an advantage from the extension of the $20,000 instant asset write-off (and the proposed reduction to the company tax rate as announced in previous Budgets). Retirees have not had any significant changes made to superannuation – which is a welcome change for an industry still trying to come to grips with the superannuation changes made from previous budgets. Scott Morrison also confirmed that the Government will not be making any changes to the current franking credit regime (we await the opposition’s Budget response to see if they will continue with their suggested changes to franking credits).

The tax changes proposed in last night’s Budget will now become part of the upcoming federal election battleground. We hope that the proposed cuts to the company tax rate and the removal of the 37% individual tax bracket will be high on the Government’s agenda.

We’ve outlined below some of the main tax and other business measures that were announced in the Budget.

As with all budgetary measures, these measures are not final until the relevant legislation has been passed by the Government. As such, it is important that you use caution in acting on these measures until they have become law. We will keep you updated on the status of these proposed measures.

Businesses

-

Instant Asset Write-off – The $20,000 instant asset write-off for small businesses (who have an aggregated annual turnover less than $10 million) has been extended to 30 June 2019. Assets acquired for more than $20,000 will be pooled and depreciated at 15% in the first year then 30% each year thereafter. The balance of this pool can be written off when it is less than $20,000.

The taxable payments annual reporting system already applies to the building industry and will extend to the cleaning and courier industries from 1 July 2018.

-

Non-compliant payments – From 1 July 2019, businesses will not be able to claim deductions for payments to their employees, such as wages, where they have not withheld any amount of PAYG from the payments, despite the PAYG withholding requirements applying.

-

Director Penalty Notices – Currently, under the Director Penalty Regime, the ATO can make directors personally liable for superannuation and PAYG withholding. The Director Penalty Regime is set to extend to GST, luxury car tax and wine equalisation tax potentially making directors personally liable for these debts also.

Individuals

-

Medicare Care Levy –

-

The Medicare levy low-income thresholds increased from the 2017-18 income year.

-

The Medicare levy rate will remain at 2%. The Medicare levy rate was previously budgeted to increase to 2.5% to pay for the NDIS. However, the Government has been able to fund the NDIS through the budget without increasing the Medicare levy.